DEFERRED SALES TRUST™ MADE SIMPLE

LESSON 3

Deferred Sales Trust™ Advantage

Understand the Blueprint for Deferred Sales Trust

DEFERRED SALES TRUST MASTERMIND

Understanding DST & DST 2.0

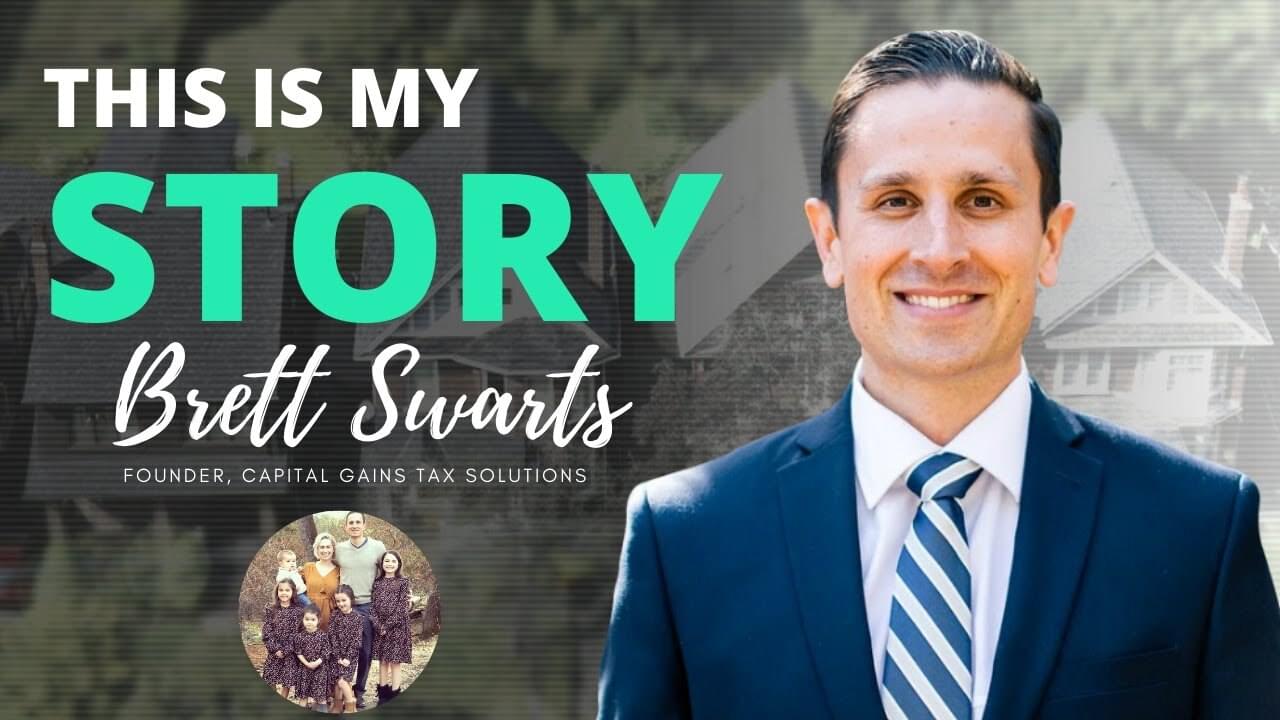

About Brett Swarts

Brett Swarts is considered one of the most well-rounded Capital Gains Tax Deferral Experts and informative speakers in the U.S. He is the Founder of Capital Gains Tax Solutions, is an exclusive Deferred Sales Trust Trustee, host of the Capital Gains Tax Solutions podcast and an eXp Commercial Multifamily Broker in Sacramento, CA.

His Millionaire Clients are challenged to create and develop a tax-deferred transformational exit wealth plan using The Deferred Sales Trust™ (“DST”) so they can create and preserve more wealth. Brett is the host of the Capital Gains Tax Solutions podcast. Each year, he equips hundreds of Millionaires break out of capital gains tax jail. He also equips business professionals with the DST tool to help their high net worth clients break out too.

GET TO KNOW YOUR TRUSTEE

WHO IS BRETT SWARTS?

Click the button below to listen to his story, how he learned about Deferred Sales Trust and his mission to help thousands of people gain more clarity on it.

This short course about Deferred Sales Trust is for educational purposes and is solely intended to provide an overview of how the Deferred Sales Trust works and can be implemented. CGTS does not provide legal, tax professional services, or advice. Each transaction and individual circumstances vary widely and participants are strongly urged to seek independent legal, tax, and professional advice.