Lesson 1: INTRO

Lesson 2: ADVANTAGE

Lesson 3: CGTS DEFERRED SALES TRUST BLUEPRINT

DEFERRED SALES TRUST™ MADE SIMPLE

Deferred Sales Trust™ Introduction

Works with any highly appreciated assets and works with cryptocurrency, stocks and a perfect 1031 exchange exit plan...

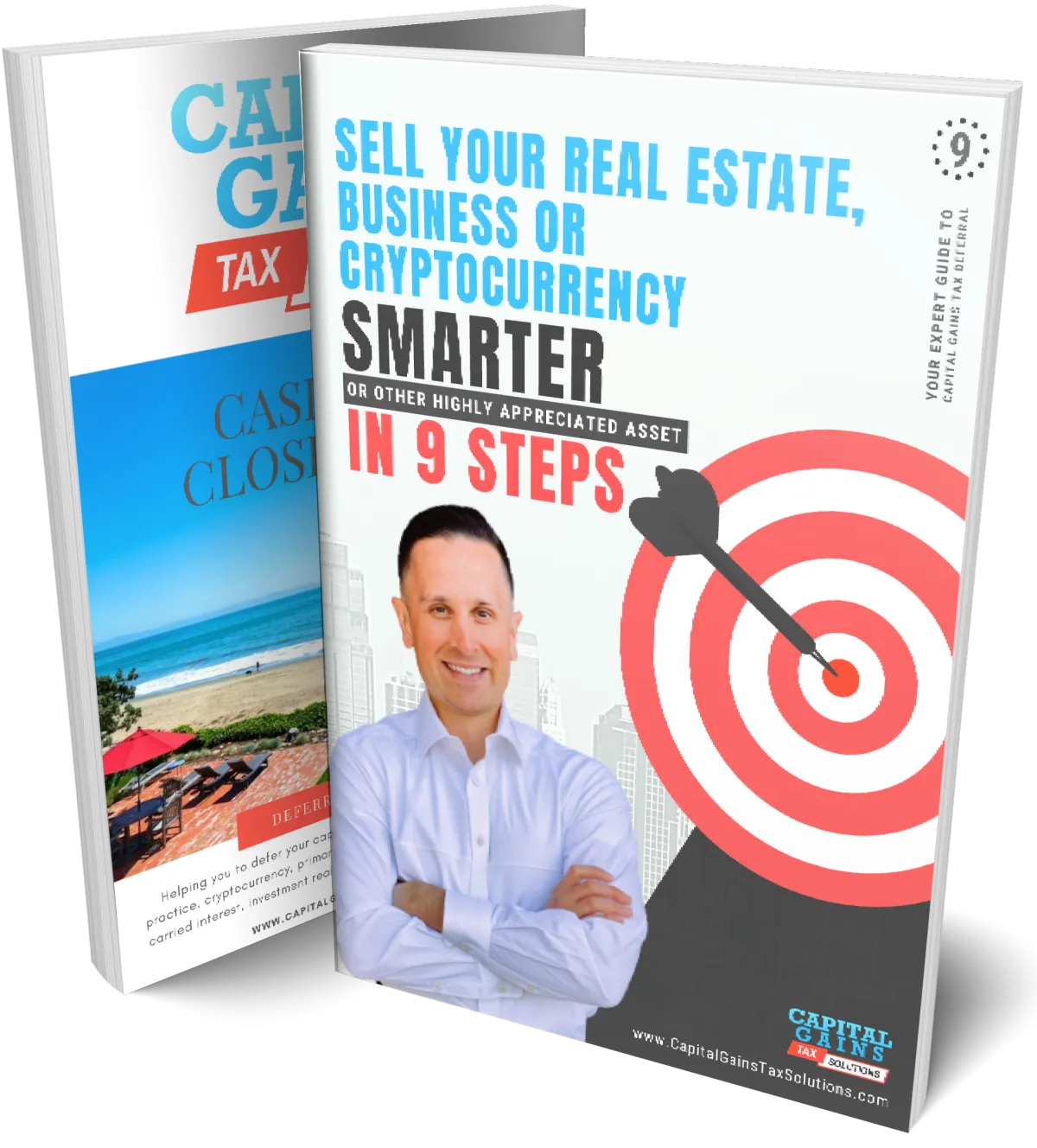

Download Our Free eBook and Deal Close Magazine

Learn our 9 Simple Steps On How To Sell Your Real Estate, Business, or Cryptocurrency Smarter. What bigger decision is there when choosing to sell your highly appreciated asset than how to defer your largest expense, Capital Gains Tax & Depreciation Recapture? There’s a lot to consider and a number of steps to navigate to make sure you don't sacrifice 30-50% of your gain to the IRS. The Deferred Sales Trust has helped owners defer capital gains taxes when they sell their businesses, primary homes, investment real estate, and other highly appreciated assets since 1996.

Lesson 1 Worksheet

Downloadable and Printable Worksheet To Help You Understand Deferred Sales Trust Basics.

FREQUENTLY ASK QUESTIONS

What Types of Assets Can be Sold Using the Deferred Sales Trust?

Just about any asset that is subject to capital gains taxation can be deferred with the Deferred Sales Trust.

These assets include businesses, rental properties, primary homes, commercial properties, private stocks, public stock, bonds, and insurance policies that need to be sold for cash. The most common types of asset sales using the Deferred Sales Trust are the sale of real estate and the sale of a business. The Deferred Sales Trust can sometimes be used for other types of asset sales and transactions such as:

• A 1031 Exchange that would otherwise fail to be properly completed can be “rescued” using the Deferred Sales Trust;

• The refinancing of a note receivable from a third party;

• Sales of marketable securities where there are restrictions on the stock or limited trading volume of such stock.

• Primary Home

• Private Stock

• Public Stock

• Carried Interest

• Captive Insurance

• Art Work

• Crypto

• NFT’s

• Business Sale

• Investment Real Estate

• Failing 1031 exchange

• Past 45 days - no problem

• GP & LP Interest

.... and other highly appreciated assets

What is the qualification of using a Deferred Sales Trust?

$1M Net Proceed and $1M gain per transaction. This applies to S-Corp, LLC, C-corp, LP, GP...etc.

When can I use Deferred Sales Trust?

Before all contingency were removed during the Due Diligence Period with at least 2 weeks prior to your closing date.

The earlier the better.

About Brett Swarts

Brett Swarts is considered one of the most well-rounded Capital Gains Tax Deferral Experts and informative speakers in the U.S. He is the Founder of Capital Gains Tax Solutions, is an exclusive Deferred Sales Trust Trustee, host of the Capital Gains Tax Solutions podcast and an eXp Commercial Multifamily Broker in Sacramento, CA.

His Millionaire Clients are challenged to create and develop a tax-deferred transformational exit wealth plan using The Deferred Sales Trust™ (“DST”) so they can create and preserve more wealth. Brett is the host of the Capital Gains Tax Solutions podcast. Each year, he equips hundreds of Millionaires break out of capital gains tax jail. He also equips business professionals with the DST tool to help their high net worth clients break out too.

GET TO KNOW YOUR TRUSTEE

WHO IS BRETT SWARTS?

Click the button below to listen to his story, how he learned about Deferred Sales Trust and his mission to help thousands of people execute a DST exit plan.

This short course about Deferred Sales Trust is for educational purposes and is solely intended to provide an overview of how the Deferred Sales Trust works and can be implemented. CGTS does not provide legal, tax professional services, or advice. Each transaction and individual circumstances vary widely and participants are strongly urged to seek independent legal, tax, and professional advice.